In the United Kingdom, crowdfunding has emerged as a dynamic financial solution that fosters innovation and supports diverse initiatives. Several platforms have acquired prominence in recent years, allowing individuals and businesses to raise funds from a large online community. These platforms provide an intuitive interface, making it easy for creators to present their ideas and for patrons to contribute financially. Whether for artistic endeavors, tech startups, or social causes, crowdfunding platforms in the United Kingdom have become the method of choice for making aspirations a reality. As a collaborative and accessible source of funding, these platforms enable individuals to connect, invest, and collectively influence the innovation and entrepreneurship landscape in the United Kingdom.

Features of Crowdfunding Platforms UK

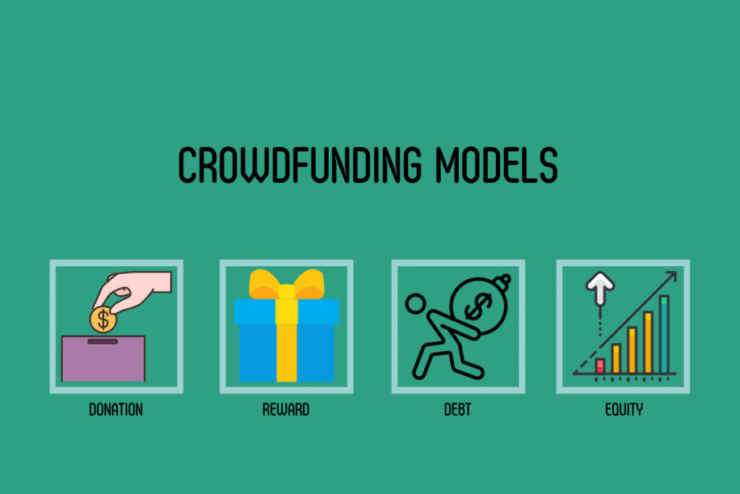

1. Diverse Funding Models

Crowdfunding platforms in the UK typically offer various funding models, allowing project creators to choose the one that aligns with their goals. The most common models include reward-based crowdfunding, equity crowdfunding, and donation-based crowdfunding. In reward-based crowdfunding, backers receive non-monetary rewards, such as early access to products or exclusive merchandise. Equity crowdfunding involves backers receiving shares or equity in the project or company. Donation-based crowdfunding, on the other hand, relies on contributions without expecting financial returns. This diversity ensures that projects of different natures and scales can find an appropriate model to attract support.

2. User-Friendly Interface

One of the key features of crowdfunding platforms is their intuitive and user-friendly interfaces. These platforms are designed to simplify the fundraising process for both project creators and backers. Creating a campaign typically involves a straightforward process of providing project details, setting funding goals, and outlining rewards or incentives for backers. On the flip side, backers can easily browse through projects, understand their objectives, and make contributions. The simplicity of the interface encourages wider participation, making crowdfunding accessible to individuals who may not have extensive financial or technical expertise.

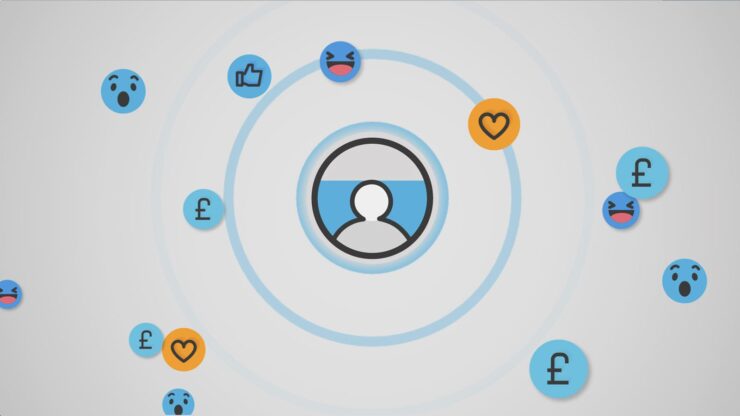

3. Social Integration and Networking

Crowdfunding platforms often integrate social networking features, enabling creators to leverage their social circles and expand their project’s reach. Users can share campaign links on popular social media platforms, creating a viral effect that helps campaigns gain momentum. Additionally, backers can engage with creators through comments, feedback, and questions, fostering a sense of community around the project. This social aspect not only aids in marketing but also allows creators to build a loyal support base. Social integration contributes significantly to the success of crowdfunding campaigns by tapping into the power of online communities.

4. Transparent Fundraising

Transparency is a crucial feature of crowdfunding platforms in the UK. Project creators are required to provide detailed information about their objectives, how the funds will be utilized, and the potential risks involved. This transparency builds trust among backers, ensuring they have a clear understanding of the project they are supporting. Some platforms also provide tools for creators to update backers on the project’s progress, creating a transparent and accountable fundraising environment. This openness enhances the credibility of crowdfunding as a legitimate means of raising funds and contributes to the long-term sustainability of crowdfunding platforms.

5. Regulatory Compliance and Investor Protection

In equity crowdfunding, where backers invest in a project with the expectation of financial returns, regulatory compliance and investor protection are paramount. Crowdfunding platforms in the UK adhere to regulatory frameworks that ensure a level playing field for both investors and project creators. These regulations often include financial disclosure requirements, background checks on project creators, and limits on investment amounts for individual backers. By complying with these regulations, crowdfunding platforms prioritize the protection of investors, mitigating the risks associated with crowdfunding investments and contributing to the overall credibility of the industry.

Is crowdfunding Legal in the UK?

Yes, crowdfunding is legal in the United Kingdom, with regulatory oversight provided by the Financial Conduct Authority (FCA). The FCA governs various crowdfunding models, including equity crowdfunding, reward-based crowdfunding, and loan-based crowdfunding, establishing rules to safeguard the interests of both investors and project creators. While equity crowdfunding involves shares and is closely regulated to maintain market integrity, other forms such as reward-based and donation-based crowdfunding operate under consumer protection laws. As a result, individuals and businesses can leverage crowdfunding platforms in the UK, each complying with specific regulations to create a transparent and lawful environment for fundraising activities.

What is the UK equivalent of Kickstarter?

The UK equivalent of Kickstarter is a platform called “Crowdfunder.” Crowdfunder is a popular crowdfunding platform that operates in the United Kingdom. Like Kickstarter, it allows individuals, businesses, and organizations to raise funds for a variety of projects, including creative endeavors, entrepreneurial ventures, community initiatives, and more. Crowdfunder supports both reward-based crowdfunding, where backers receive non-monetary rewards in return for their support, and equity crowdfunding, where backers receive shares or equity in the project or company. It provides a user-friendly interface, social integration features, and compliance with UK regulatory standards, making it a prominent crowdfunding option for those based in the United Kingdom.

What are the 4 types of crowdfunding?

1. Reward-Based Crowdfunding

In this model, backers contribute funds to a project and, in return, receive non-monetary rewards or incentives from the project creator. These rewards can range from early access to products, exclusive merchandise, or other creative and tangible items.

2. Equity Crowdfunding

Equity crowdfunding involves backers investing in a project or company in exchange for shares or equity. Instead of receiving rewards, backers become partial owners of the venture and stand to gain financially if the project succeeds.

3. Loan-Based Crowdfunding (Peer-to-Peer Lending)

Also known as peer-to-peer lending, this crowdfunding type entails backers providing loans to project creators. Backers receive repayment with interest over time, turning the crowdfunding process into a form of lending.

4. Donation-Based Crowdfunding

In donation-based crowdfunding, backers contribute funds without expecting any financial returns or equity. This model is often associated with charitable causes, personal needs, or community projects where individuals contribute for altruistic reasons rather than for tangible rewards or financial gains.

How do I do a crowdfund UK?

Individuals and organizations can use prominent crowdfunding platforms such as Kickstarter, Indiegogo, and Crowdfunder to launch a campaign in the United Kingdom. Create a compelling campaign page with a clear project description, objectives, and backer rewards. Set a realistic funding goal and duration for your campaign, and advertise it via social media and email newsletters. Comply with British regulations regarding crowdfunding, which may include providing accurate financial information and addressing tax considerations. Engage with your backers and keep them apprised of your campaign’s progress to build trust and improve your chances of reaching your funding target.

Conclusion

Launching a UK crowdfunding campaign on Kickstarter, Indiegogo, or Crowdfunder can be effective with proper planning and compliance. A great project description, clear goals, appealing backer rewards, realistic financial targets, and effective promotion are vital. UK crowdfunding requirements, including financial openness and taxation, must be followed. Engaging backers, providing updates, and being transparent can build trust and help you reach your financing goal. UK crowdfunding campaigns can realize unique ideas and attract enthusiastic backers.