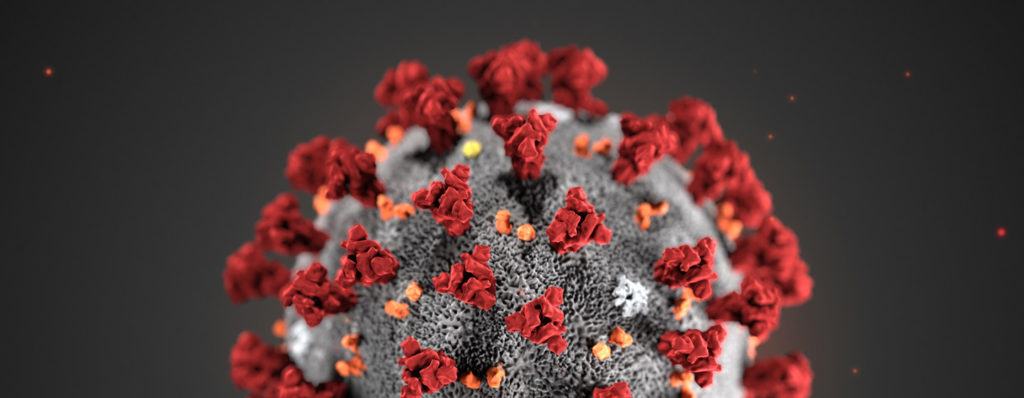

Over the past few decades, nothing has made a huge impact in the world like the current COVID-19 pandemic. Government and major health sectors all around the world are advised to incorporate self-quarantine and social distancing into their daily lives. The primary reason behind this is that the disease is spread from person to person through droplets transmitted into the air from sneezing and coughing.

With the rise of confirmed cases and death rates, people all around the world are frightened in a way we have never seen before. Along with this worldwide panic is the disruption of normal working practices for a myriad of employees, businesses, and companies. Some of the industries find it almost impossible to maintain production or services. Their utmost worry is how do they cope with their personal financial issues during this on-going pandemic.

Will I still get paid even if my workplace is shut down?

Employees of any company should still get their normal salary even if their workplace is shut down. The only exception for this is if the company lays off some of its employees to lessen their expenditure and payable. In this case, the laid-off employee will be entitled to a five-day worth of salary.

However, if the employment contract does not state anything about this, then the employers can require their staff members to take annual leave, while the company is temporarily shut down because of the outbreak.

Back in March, we witnessed head that the government intended to pay 80% of salaries after it decided to close all of the pubs in the country. This percentage referred to people who were facing unemployment after the whole country was put in a lockdown after the pandemic started. Moreover, we have seen that the only limitation was the maximum level of this coverage is £2,500 per month. Furthermore, these measures applied to all types and sizes of companies.

Working from Home

In case your employer has what is needed to equip you to work from the comfort of your home, you not going to your workplace is going to be the only thing that will change. When we say this, we also address the salary you are earning. Even the public sector took some precautions and create measures that will prevent job loss that was the biggest fear among people when the global pandemic started. We can take a look at some countries in the world that had been very successful in doing just that. In the beginning, it looked like it was inevitable. Thankfully, the world managed to prevent the biggest percentage of job loss.

When it comes to the private sector, for several industries this wasn’t too hard. Naturally, the IT sector is the first one that comes to mind. In fact, Google was among the first companies that started using these precautions. By the looks of it, they did a pretty good job. A high percentage of the companies who had the necessary elements to implement these measures didn’t lower the salaries of their employees since their amount of work is almost unaffected by the global pandemic.

Money Worries

Sadly, not all of the industries find it that easy to find the right measure for these hard times. For some of them, it is almost impossible to perform under these circumstances, even though the employers are trying to find the best way of organizing.

In the wake of the COVID-19 pandemic, attaining government plans is now easier for people who want to claim their sick pay and receive their benefits. However, the bad news is that the benefits that one can get are far below what most people need in order to pay for their household costs and daily essential needs.

“The government is currently making changes to make the process easier and quicker for people to claim their sick pay and receive their needed benefits. Sick pay would be 94 euro per week, and the given standard allowance would be 73 euro per week.”

As seen in the statement above, the amount of allowance one can receive is perceived to be less than one-fourth of the average income in the UK. As the confirmed cases for COVID-19 increases, the debts of people starts to mount up as well.

Ask For Support & Help

Insider info from now loan UK banks including TSB, Royal Bank, of Scotland and Lloyds offer repayment holidays on loans and mortgages. If you are someone who’s income has abruptly dropped because of the COVID-19 outbreak, whether you or a family member is ill, or your work hours have been cut off, you should ask your creditors for a payment break or to freeze the interest while this pandemic is last. This can be considered as a relief for someone who is experiencing a hard time with their repayments.

The good news is, according to the Financial Conduct Authority, car financing would be part of the temporary relief measures to support and give relief to households who are facing financial hardship due to the pandemic.

On the other hand, the government has also introduced two loan options to support UK businesses that were affected by the COVID-19 pandemic.

Coronavirus Business Interruption Loan Scheme (CBILS) COVID Corporate Financing Facility

The Conclusion

In the midst of this crisis, we should not allow worry and anxiety to overcome us. Missing a few credit card payments does result in insolvency and court trials. It is important to keep yourself from a depressive state. Try thinking about positive things in your life and on which fields you can improve yourself since you have a lot of time for learning during the lockdown. Moreover, this is not something that anyone has an influence on. Bad times like this are inevitable. But in worst of times, there is still hope. What is important is how we will perform after this global pandemic is past us. You can be sure that there is a lot of work stands in the future for all countries in the world.